The channel market is wondering today if Waterloo, Ont.-based BlackBerry has sent up the white flag.

BlackBerry, after a mostly an up and down year since the release of BB10, confirmed in a press release that it has started discussions on the exploration of strategic alternatives for the 29-year-old company of which one option is to sell the firm.

Another option that is being discussed recently, which was reported in CDN last week, was to take the company private.

The release went on to say that BlackBerry’s Board of Directors formed a special committee to explore these strategic alternatives in an attempt to enhance and maintain shareholder value, while increasing scale in order to accelerate BlackBerry 10 deployment. Besides an out-right sale or going private, BlackBerry’s board are mulling over these other options: joint ventures, strategic partnerships and alliances.

Special committee members are Barbara Stymiest, Thorsten Heins, Richard Lynch and Bert Nordberg, and it will be chaired by Timothy Dattels.

Heins is the company CEO, while Stymiest was just named chairwoman of BlackBerry earlier this year. Lynch is a former VP of service provider Verizon. Nordberg is the former CEO of Sony Ericsson. Something to note about Lynch and Nordberg are that both were out of work when BlackBerry added them to the board.

As for Dattels, he is key to this whole process. Dattels is a senior partner at TPG Capital, a large San Francisco-based private equity investment firm which an expertise for leveraged buyouts. TPG Capital currently has more than $56 billion of capital at its fingertips.

If you are looking for a connection to a potential new buyer for BlackBerry; look no further than to Dell; as TPG employs the former CEO of Dell Kevin Rollins.

One person you will not see on this special committee is Prem Watsa, chairman and CEO of Fairfax Financial, BlackBerry’s largest shareholder. Watsa resigned from the board and special committee saying potential conflicts might arise during the process. Watsa went onto say that he continues to be a strong supporter of the company, the board and management.

Watsa added that Fairfax Financial has no current intention of selling any of its BlackBerry shares.

BlackBerry issued two statements as a result of this news. The first came from Dattels:

“During the past year, management and the Board have been focused on launching the BlackBerry 10 platform and BES 10, establishing a strong financial position, and evaluating the best approach to delivering long-term value for customers and shareholders. Given the importance and strength of our technology, and the evolving industry and competitive landscape, we believe that now is the right time to explore strategic alternatives.”

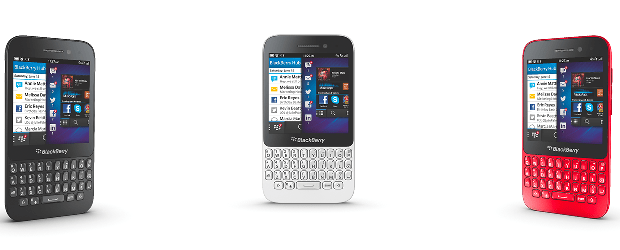

The second was from Heins: “We continue to see compelling long-term opportunities for BlackBerry 10, we have exceptional technology that customers are embracing, we have a strong balance sheet and we are pleased with the progress that has been made in our transition. As the special committee focuses on exploring alternatives, we will be continuing with our strategy of reducing cost, driving efficiency and accelerating the deployment of BES 10, as well as driving adoption of BlackBerry 10 smartphones, launching the multi-platform BBM social messaging service, and pursuing mobile computing opportunities by leveraging the secure and reliable BlackBerry Global Data Network.