Standing in the Starbucks line the other day I watched folks stand there with their eyes glazed over as they chose the size, flavour, foam/cream they wanted and then had to decide if they were going to pay with cash, credit, debit or Starbucks card or if they were going to use their smartphone.

How archaic.

How cumbersome.

How confusing, since the value of the transaction varies according to where in the world you are.

If you’re in Iceland, Greece, Japan, Maldives, the U.S., wherever, it’s the same planet but different money.

However, take the Star Trek reference; Captain Kirk, Mr. Spock, the Enterprise (we know, weird logic).

They bravely went from world to world and never had a payment issue; it was one “understood” standard.

Why can’t we do the same here on earth?

Oh, that’s right, there are too many folks making too much money as go-betweens.

Use a credit/debit card and you pay for something and one or more intermediaries take a slice for passing the transaction/payment through their system (1s and 0s not money); and in the U.S., someone(s) got paid $71.7B according to Nilson Report.

Use it enough and the magnetic strip wears out.

Phone companies, big merchants, cute new consolidation cards, smartphone apps/add-ons and more have tried to get a piece of the action.

People keep falling back on using paper money I guess because you can feel it, touch it, count it.

Money is Heavy – Old-fashioned cash is a real bear to carry with you all the time. Just think back on how difficult it was to carry a million dollars with you just in case. Suddenly, the fun is all gone.

Admit it, it’s really cumbersome to carry large sums around.

And paper denominations last only a year or two before they’re recycled.

The real pain is they vary from country to country for no real reason.

Look at it, they say it’s worth something but it’s just a piece of paper backed by your/ their government and you know how solvent your/their government is.

If they transfer sums of your paper money to some other city, state, country; they do it electronically (1s, 0s).

Logic says there’s no need for all of these environmentally-consuming alternatives that are worth something based on their promise.

Instead, the world just might as well take a leap into the final frontiers and convert to BitCoin or some singular electronic standard of pluses and minuses.

We’ve had the promise of the mobile wallet bouncing around — payment by hitting a button on a phone — and a host of start-ups keep trying to cash in on it.

But as Spock said, “A machine can be computerized, not a man.”

They face the same hurdles as those who came before them — people aren’t aware of the new payment systems, folks are confused by the choices and stodgy folks think mobile is just a new-fangled idea when they’re happy with pockets full of cash, credit cards.

What is it Worth – Look at folding currency and what does it say … promissory note or something like that. It’s easier to use your smartphone to transfer 1s and 0s and it’s still a promise.

Of course, that doesn’t stop folks from talking about, wishing for a mobile payment revolution.

Samsung tried. Google offered Google Wallet. Apple’s CEO Tim Cook called it “an area of interest.”

Mobile Billfold – Millenials and younger folks are becoming increasingly comfortable with alternative banking and using their smartphone to conduct all of their business transactions.

Gartner estimated that worldwide, people spent $235.4 billion through mobile payments last year, compared to $163.1 billion in 2012.

But that number is much smaller in North America, where consumers spent about $37 billion through mobile transactions in 2013, up from $24 billion the year before.

That seems trivial to the global flow of money, even if you go back a few years.

Big Float – The global supply of money keeps increasing but the amount of currency in circulation has remained relatively constant.

Since U.S. President Richard Nixon closed the gold window back in ’71, it’s become obvious that it is all just funny money!

It’s sorta’ like Dick Cheney saying, “Deficits don’t really matter.”

That means digital currencies are a “killer app” for mobile commerce.

After all, they must be real because the IRS classified crypto-currencies as a taxable “asset.” New York’s Dept of Financial Services asked people interested in trading in virtual currencies to contact them, several online firms have offered to use them as payments; so whatever it is, it just might work.

Digital Money – While cybercurrency presently has cache with the technical crowd, it is being increasingly accepted by individuals and organizations around the globe.

As close as I can determine cyber-money isn’t much different from an individual country’s reserve notes.

Of course, Wall Street and the banks can’t control it; so that may hold it back a little.

Even though cyber-currency doesn’t have a legal tender status – anywhere – that isn’t stopping governments from trying to regulate it … once they (and we) figure out exactly what “it” is.

Or, as Scotty said, “We have a saying: Fool me once, shame on you. Fool me twice, shame on me.”

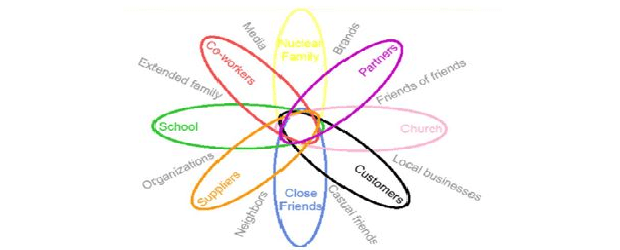

Variety – Organization with digital wallet solutions are all pushing hard to become one of the winning standards, including traditional sources like banks and credit card firms. Digital wallet solutions have long been used in Africa and the Far East for micropayments.

All of the other mobile payment schemes we’ve come up with seem to be bridge solutions that are still based on some plastic or paper.

If we can get an international standard cyber-currency that is universally accepted, logic says that passing through the Internet should be a lot less costly for both the seller and the buyer.

Of course, there’s always that gnawing concern about security.

Bad people already know how to sniff out digital signatures on digital wallets. So now all they need to do is focus on the exchanges and places where your cyber-currency exists.

Hey, the idea is great!

Of course, the devil is in the details since I guess someone has to regulate it like the World Bank or heck, we could all fire up our systems and knock out a big bunch of 1s and 0s.

And there’s nothing worse than an oversupply … of anything.

Kirk tried alternative payments but when folks started hoarding and things got out of hand, he went back to universal payments.

He simply ordered, “I want these things off my ship! I don’t care if it takes every man we’ve got – I want them off the ship!”