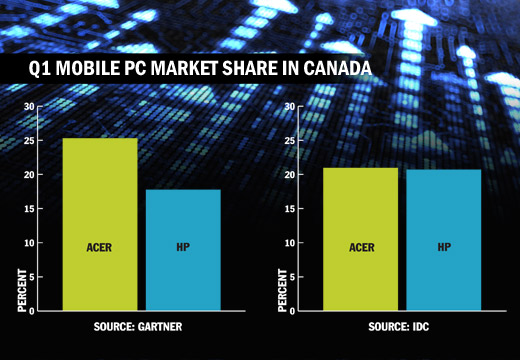

Who’s in first? Depends who you talk to. The Canadian mobile PC market has long been a tight race, but Acer Canada is trumpeting research from Gartner that shows it opening-up a significant lead on rival Hewlett-Packard Co. But according to analyst firm IDC Canada, HP still maintains a small lead over Acer in the Canadian market.

According to Gartner, in Q1 of 2011 Acer captured 25.3 per cent of Canada’s notebook market, well ahead of second-place HP at 17.8 per cent. Mikako Kitagawa, a principal research analyst with Gartner, said seasonal and other one-time factors can impact one quarter’s results, so it’s important to look at the trend over several quarters. Over the last few quarters until this one, Gartner actually had HP growing in Canada and Acer declining.

“In this quarter Acer had a rebound after a decline trend over the last few quarters, but that doesn’t mean it will continue,” said Kitagawa. “Acer and HP will always be competing. This is the first time we’ve had Acer higher compared to HP, and they could take it back at some point. I can’t really see Acer’s position for now being stable.”

Kitagawa said inventory levels could have been low for Acer in previous quarters, leading to the decline. She also noted Gartner looks at shipments into the channel, not sales out, and differences in methodology between research firms could lead to discrepancies.

For Q1 of 2011, IDC Canada has HP in first for Canadian portable PC shipments at 20.6 per cent of the market, just barely ahead of Acer at 20.4 per cent. Dell was third, followed by Toshiba. Acer’s numbers have been steady over several quarters, while HP’s dropped from 26.9 per cent in Q4 of 2010 and 27.1 per cent in Q3 of 2010.

“Acer was on top back in Q1 of 2009, so it’s not new. It’s been an HP/Acer race for quite awhile,” said Tim Brunt, senior analyst for personal computing with IDC Canada. “Mini notebooks propelled Acer into first in 2009.”

With the recent tightening in IDC’s numbers coming from a markershare decline by HP, Brunt noted Acer hasn’t gained a lot of market share over the last year.

“The marketplace is unpredictable and it’s a volatile marketplace right now,” said Brunt. “It’s interesting to watch.

Another interesting point of comparison between the vendors is average selling price. Acer’s is lower, according to IDC, with an average selling price for portables of $644, compared to $690 for HP.

Brunt said he believes Acer has a lower overall expense cost than HP which leaves it more room to be flexible on pricing, but he also adds HP’s average unit price could be higher because it’s more active in the enterprise space than Acer is.

Acer Canada general manager Terry Tomecek said the Gartner numbers give Acer probably its strongest lead in Canada yet, but said they’ve been neck-in-neck with HP since Acer’s purchases of Gateway and eMachines

“Our three-brand strategy has contributed mightily to get more shelf-space at retailers,” said Tomecek, noting HP also has two brands, with Compaq. “We also offer a tremendous amount of SKUs at every price-point, regardless of brand. So we’re giving a lot of options to the retailers. It’s just a very complete produce-line combined with a three-brand strategy.”

Tomecek said Acer provides the same numbers to all research firms which they then go and audit so he can’t explain the difference, although he does note IDC does generally tend to put Acer lower than other research firms. There could be differences in methodologies, and he notes Acer doesn’t have a warehouse in Canada, shipping product from both Asia and the U.S.

He dismissed rumours that Acer has been increasing inventory to unusual levels, or taking-on a glut of inventory from the U.S. at discounted rates.

“Absolutely not true. Our inventory today is the same as our inventory all the time. We’re getting ready for back to school, which starts really in July, said Tomecek. “All vendors are starting to fill that need.”

An HP Canada spokesperson was unavailable for comment.

Follow Jeff Jedras on Twitter: @JeffJedrasCDN.