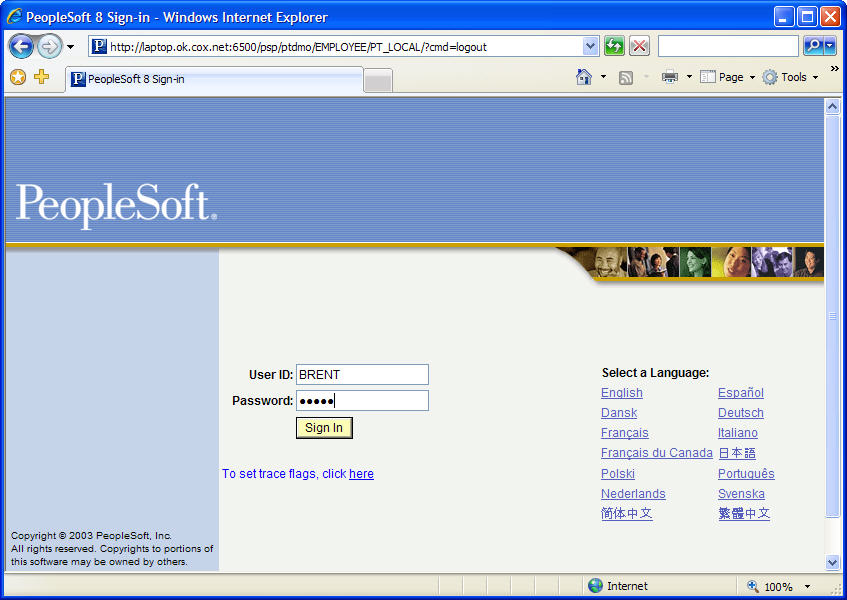

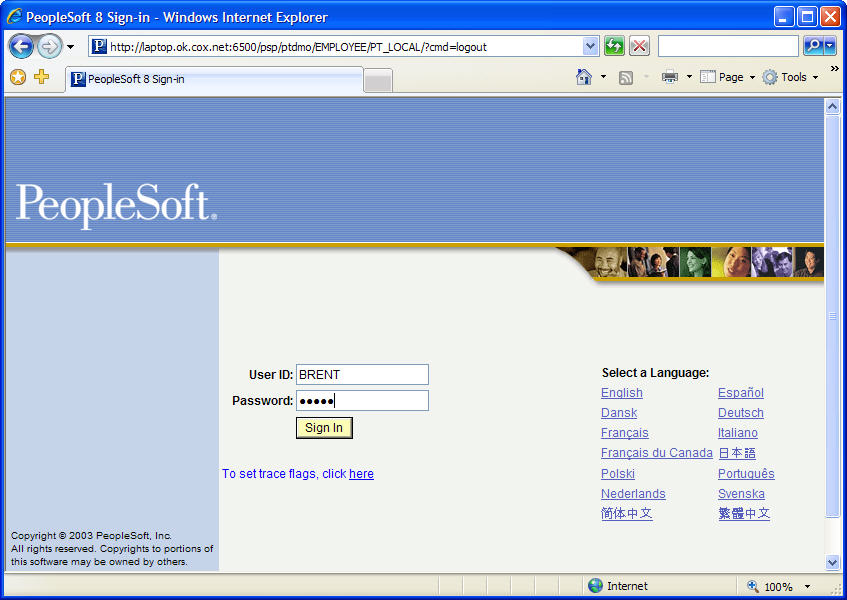

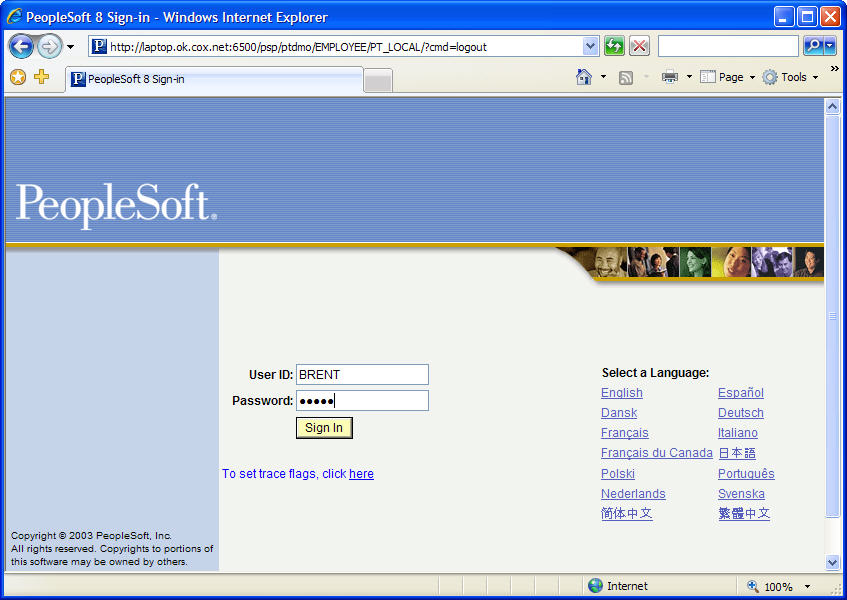

3. Oracle buys PeopleSoft, ($10.3 billion)

Oracle did not have an easy time acquiring PeopleSoft. The company, which today is the second largest software maker by revenue (after Microsoft) spent a year and a half aggressively going after rival software maker PeopleSoft. It finally came to friendly terms in 2005 when it offered $10.3 billion in cash, or $26.50 a share, for PeopleSoft, up from $9.2 billion or $24 a share which it had previously claimed was its last offer.

2. Symantec buys Veritas ($13.5 billion)

In what would be a decade in the making, storage management software maker Veritas Software Corporation was purchased in 2005 and only reemerged as Veritas Technologies Corporation under Symantec this year.

During this time, the software developer was first integrated into Symantec before the latter announced (last October) it would be splitting off the subsidiary, which now handles information management. With the purchase, however, Symantec gained access to Veritas’ various Fortune 500 clients.

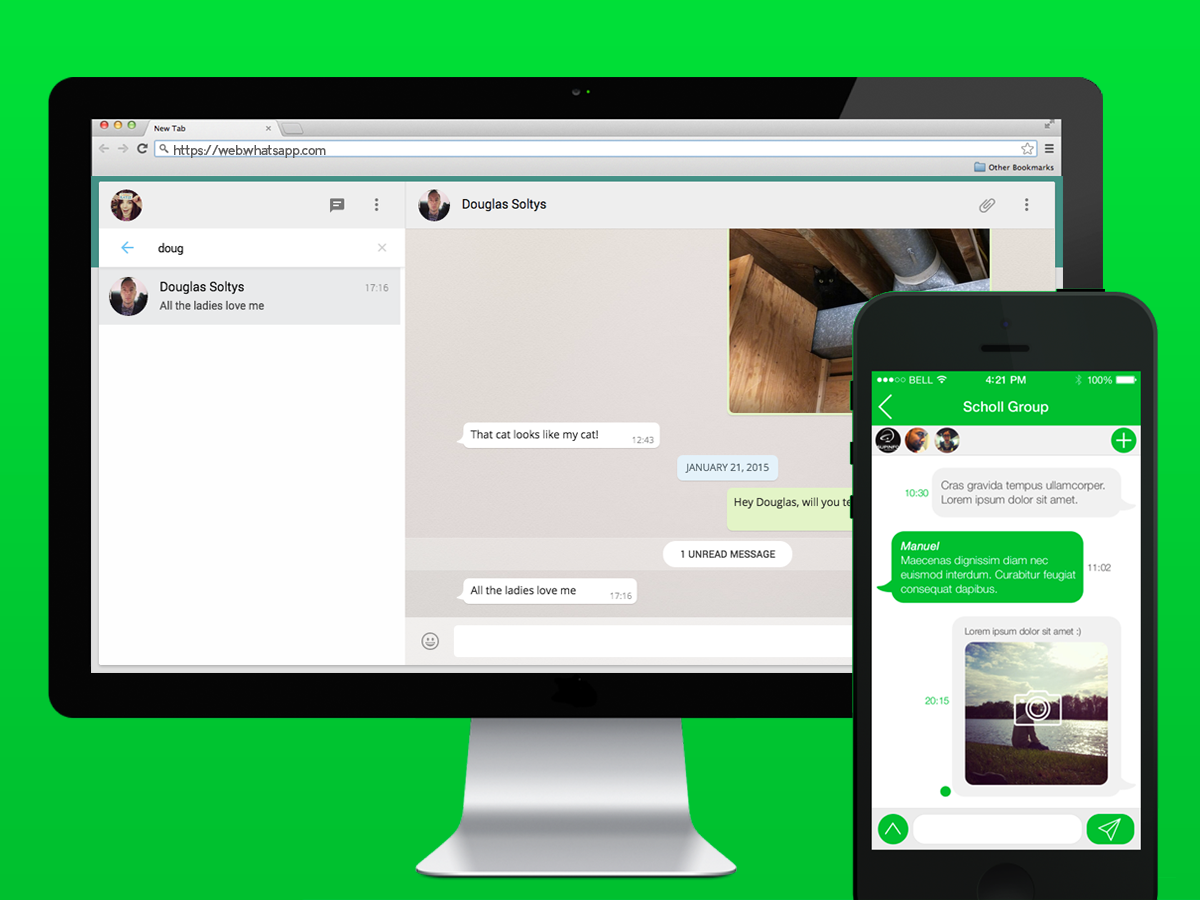

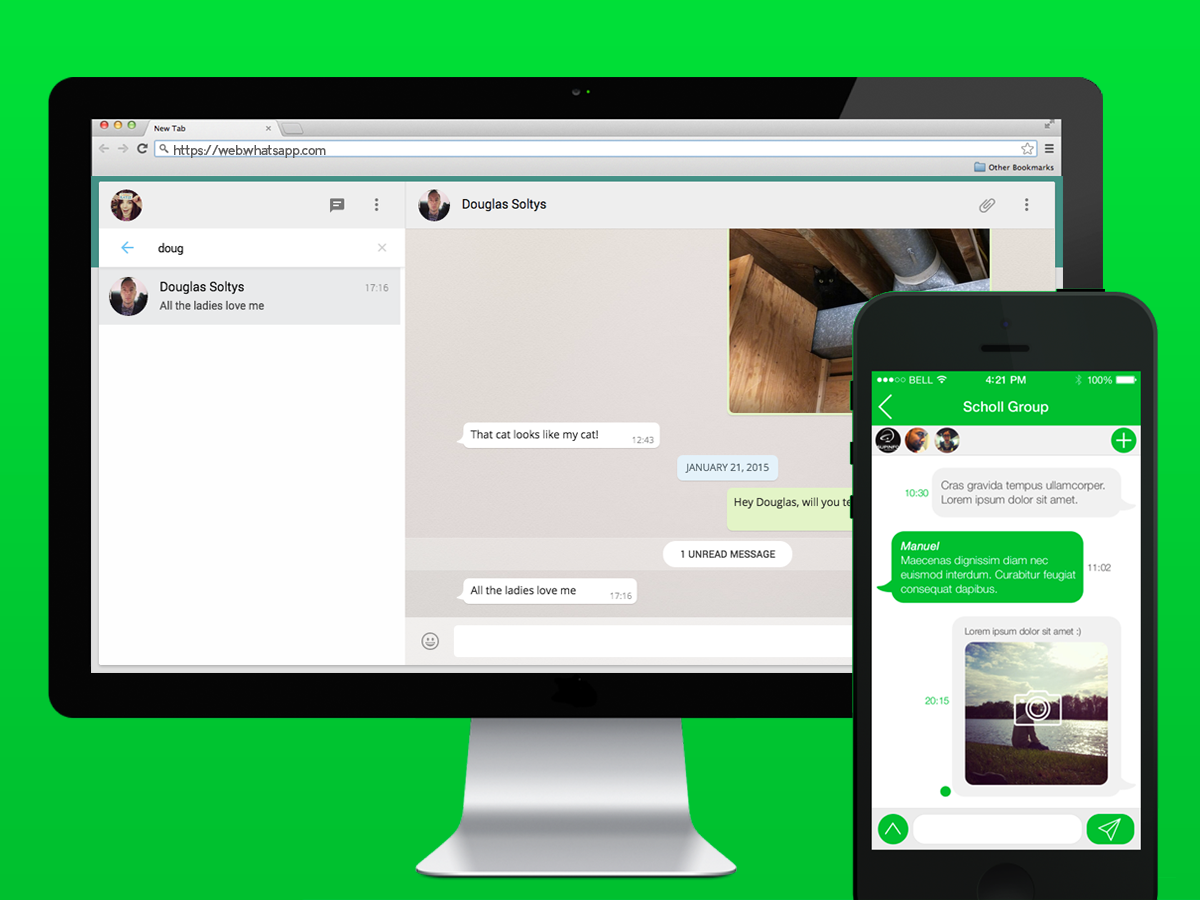

1. Facebook buys WhatsApp ($19 billion)

Is $19 billion too much to pay for an app? Not if you’re Facebook, and not if your goal is to simply amass as many users (and their data) as you can.

The 2014 deal which may have costed the social network up to $22 billion when all was said and done, netted it more than just a hugely popular internet-based messaging app, it also came with 450 million users.

In January this year, WhatsApp’s user base had grown to 700 million.

Honourable mention: AOL buys Time Warner, $106 billion

It’s hard to talk about Salesforce’s price tag of $55-70 billion without recalling the biggest tech acquisition of all time. While AOL paid the twelve-digit figure for the media corporation, the former has all but faded in part due to the dot-com bust.

How would a Salesforce acquisition by Microsoft fare today?

Marc Benioff, CEO of Salesforce. Image courtesy of Steve Jennings

Recent reports indicate that talks between Microsoft and Salesforce to acquire the Software-as-a-Service provider have fallen through. The deal, which Microsoft valued at $55 billion but Salesforce CEO Marc Benioff pegged at $70 billion, would have been one of if not the most expensive software acquisition in history.

In light of this, CDN takes a look at the biggest software acquisitions in history.

5. Microsoft buys Skype ($8.5 billion)

It seemed at one point everyone wanted a piece of Skype. Before video calling took off, the software company was owned by eBay and changed hands to a group called Silver Lake Partners in 2005 and 2009 respectively. Everyone began to see the potential of the platform in 2011, however, when Google, Facebook and Microsoft all sought to acquire the company. Microsoft won out in the end.

4. HP buys Autonomy ($10.3 billion)

Less than a decade after buying Compaq for $17.6 billion, HP decided to make another big purchase. As in the case of Compaq, its acquisition of software maker Autonomy in 2011 proved unwise; HP admitted a year later that it had overpaid for the company, accusing Autonomy of cooking the books.

Since the deal turned sour, the companies have resorted to finger pointing, with both HP and Autonomy execs fired in the process.

3. Oracle buys PeopleSoft, ($10.3 billion)

Oracle did not have an easy time acquiring PeopleSoft. The company, which today is the second largest software maker by revenue (after Microsoft) spent a year and a half aggressively going after rival software maker PeopleSoft. It finally came to friendly terms in 2005 when it offered $10.3 billion in cash, or $26.50 a share, for PeopleSoft, up from $9.2 billion or $24 a share which it had previously claimed was its last offer.

2. Symantec buys Veritas ($13.5 billion)

In what would be a decade in the making, storage management software maker Veritas Software Corporation was purchased in 2005 and only reemerged as Veritas Technologies Corporation under Symantec this year.

During this time, the software developer was first integrated into Symantec before the latter announced (last October) it would be splitting off the subsidiary, which now handles information management. With the purchase, however, Symantec gained access to Veritas’ various Fortune 500 clients.

1. Facebook buys WhatsApp ($19 billion)

Is $19 billion too much to pay for an app? Not if you’re Facebook, and not if your goal is to simply amass as many users (and their data) as you can.

The 2014 deal which may have costed the social network up to $22 billion when all was said and done, netted it more than just a hugely popular internet-based messaging app, it also came with 450 million users.

In January this year, WhatsApp’s user base had grown to 700 million.

Honourable mention: AOL buys Time Warner, $106 billion

It’s hard to talk about Salesforce’s price tag of $55-70 billion without recalling the biggest tech acquisition of all time. While AOL paid the twelve-digit figure for the media corporation, the former has all but faded in part due to the dot-com bust.

How would a Salesforce acquisition by Microsoft fare today?

Marc Benioff, CEO of Salesforce. Image courtesy of Steve Jennings

Recent reports indicate that talks between Microsoft and Salesforce to acquire the Software-as-a-Service provider have fallen through. The deal, which Microsoft valued at $55 billion but Salesforce CEO Marc Benioff pegged at $70 billion, would have been one of if not the most expensive software acquisition in history.

In light of this, CDN takes a look at the biggest software acquisitions in history.

5. Microsoft buys Skype ($8.5 billion)

It seemed at one point everyone wanted a piece of Skype. Before video calling took off, the software company was owned by eBay and changed hands to a group called Silver Lake Partners in 2005 and 2009 respectively. Everyone began to see the potential of the platform in 2011, however, when Google, Facebook and Microsoft all sought to acquire the company. Microsoft won out in the end.

4. HP buys Autonomy ($10.3 billion)

Less than a decade after buying Compaq for $17.6 billion, HP decided to make another big purchase. As in the case of Compaq, its acquisition of software maker Autonomy in 2011 proved unwise; HP admitted a year later that it had overpaid for the company, accusing Autonomy of cooking the books.

Since the deal turned sour, the companies have resorted to finger pointing, with both HP and Autonomy execs fired in the process.

3. Oracle buys PeopleSoft, ($10.3 billion)

Oracle did not have an easy time acquiring PeopleSoft. The company, which today is the second largest software maker by revenue (after Microsoft) spent a year and a half aggressively going after rival software maker PeopleSoft. It finally came to friendly terms in 2005 when it offered $10.3 billion in cash, or $26.50 a share, for PeopleSoft, up from $9.2 billion or $24 a share which it had previously claimed was its last offer.