What a weird summer this is turning out to be compared to the past ten years!

Generally, us consultants are very busy in the summer doing strategies, migration plans and acquisitions to be implemented in the last quarter of the year or following year. Not so much this year, as compared to past years!

Vendor comments about summer challenges

We have heard from many vendors, whether channel partners, VARs or Telcos that a lot of customer acquisition projects have been conceptually approved, but not signed. In many cases, the final approval with legal paperwork has not been provided, which is causing delays in orders being booked and implemented. Some of this is due to negotiations details differences, particularly related to the different performance expectations between customers and vendors.

We find this interesting, particularly given the 100,000+ customers of the older Nortel equipment that have systems that are at end-of-life and obsolete. Many of these customers are not aware of this, or the future increased costs and challenges they will face over the next few years. (Thinking about it, perhaps I will use this as a topic for another article…the REAL Y2K for former Nortel system owners.)

Customer comments about this summer’s challenges

Multiple customer IT sources have said that they can’t get IT capital budget released due to funds being moved for other initiatives in their organizations. Some of these IT folks have said that they are also hesitant in making the wrong vendor decisions, and thus have been holding off on final approvals.

Causes of confusion and hesitation

In sitting by the pond with a beverage or two with my partner Stephen W. Lawson, we were reflecting on what has changed this year compared to other years.

We came up with a few points to consider that may be effecting customer acquisitions and deployments:

Industry Factors

- Ongoing consolidation of major manufacturers with niche players

- Continued consolidation through acquisition of vendors

- Entry of new cloud players offering alternative approaches to customer premise solutions at lower price points or alternate finance models (CAPex versus OPex)

- Newer players now looking for new owners (Multiple instances here, i.e. ININ, Shoretel, etc.)

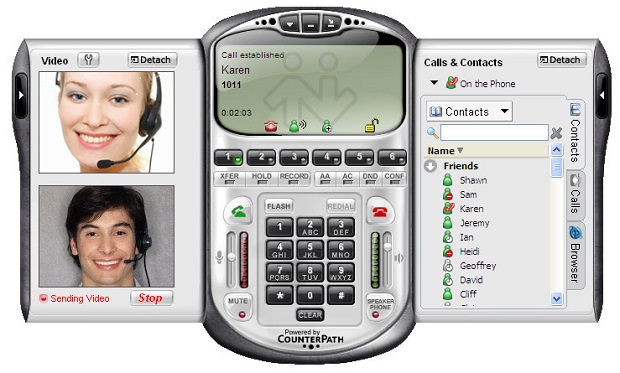

- Expanding capabilities of IT vendors in the telecom space (Microsoft’s third generation of telephone applications – Skype for Business)

Customer Factors

- Perception and reality of traditional voice communications becoming less important and being used less often by both employees and customers within customer base (as shown through our UC procurement analysis of future business requirements)

- The non-IT business units have been able to get capital investments for technology projects rather than IT groups (who’s budgets continue to hold or decrease depending on the sector and organization)

- Move of ownership and accountability away from dwindling telecom resources that have been consolidated into IT departments

- Many next-generation pilot projects seem to be stalled, and not able to move from pilot into production in any meaningful way, from a volume perspective

What are the reasons for the stall and delays?

In our internal use of UC&C applications over the last seven years, combined with our move from 100% customer premise solutions (for all our messaging, telecom and collaboration apps) to totally cloud platforms, we have observed there are numerous challenges and shifts. Some of the shifts required are on our side, as clients, and some are on the vendors’ side.

These challenges, and changes required, do not have that much impact for a small team of tech savvy consultants like us FOX GROUP folks. We have observed significant changes in skills and expertise required for IT resources across all sectors.

We have also observed the change management and training impact for general workers trying to use the next generation UC application; many who do not initially have the skills to use and manage their own desktop/mobile apps.

One of the main challenges we have observed, and commented on in past articles, is the shift required by IT professionals from hands-on tech support of their own internal systems and applications to being able to manage multiple vendors required for a cloud/managed environment.

Vendor and Customer Challenges – Very Similar

In fact, the same challenges apply on the vendor side as the customer expect the vendor organizations to have adapted to being the virtual-IT organization for the customers’ operations.

We are not aware of any courses that teach IT, accounting and legal professionals on how to manage vendors related to day-to-day operations, performance/financial management or vendor contract management.

As early-adopter cloud clients and vendors have discovered, there are challenges on both sides of the table, whether totally cloud, or hybrid combinations. Go figure!

So what does it all mean?

I believe that this “Summer of confusion” is caused by all of the various factors outlined above, which breed FUD – Fear, Uncertainty and Doubt!

Until the industry can develop the capabilities to successfully communicate the unique business benefits of switching over, or upgrading to their UC&C solutions, clients will keep a close-hand on their wallets and not open up to spend money for next generation solutions to the levels that the industry would like.

Do not hesitate to contact Roberta Fox to discuss further. As always, I welcome your thoughts, feedback and comments. You can contact me at Roberta.Fox@FOXGROUP.ca or 289.648.1981