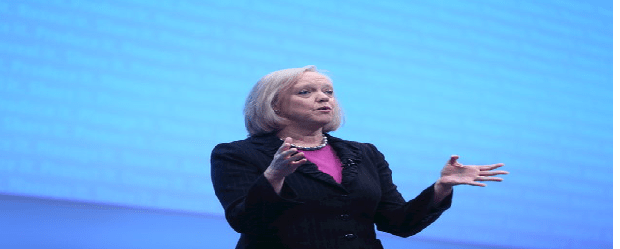

LAS VEGAS – When Meg Whitman took over as chief executive at troubled Hewlett-Packard Co. in 2011, no one doubted she had an enormous job ahead of her. So every time she speaks, the industry and the stock market pay particular attention.

Like it or not, there will be high expectations from a least one industry analyst when Whitman takes the stage here before 10,000 attendees for the annual HP Discover conference for enterprise infrastructure products.

“The world is waiting to hear something big,” Glenn O’Donnell, vice-president and research director for infrastructure products and services at Forrester Research, said in an interview here.

“She has a hard job straightening the ship out. But we’ve seen some progress and that warms my heart.”

HP was in a “tailspin,” O’Donnell said from a number of decisions made by previous CEOs, including the controversial $10 billion decision by Leo Apotheker to buy British business intelligence software provider Autonomy Corp. (a decision she backed as a member of the board), Apothoker’s musings about the future of the PC division and previous CEO Mark Hurd’s cost-cutting.

Under Hurd “innovation came to a halt” at HP, said O’Donnell.

What Whitman has done in two and a half years is restore confidence in buys and the market, O’Donnell said.

Things are still a little shaky. Last month HP reported quarterly revenue was US$27.3 billion, down one per cent from the same period a year ago. But it was staying in the black, with a $1.3 billion profit, helped by large layoffs – 34,000 so far. Another 12,000 are expected to go over the next year.

“With the first half of our fiscal year completed, I’m pleased to report that HP’s turnaround remains on track,” Whitman said in a statement with the release of the figures. “With each passing quarter, HP is improving its systems, structures and core go-to-market capabilities. We’re gradually shaping HP into a more nimble, lower-cost, more customer- and partner-centric company that can successfully compete across a rapidly changing IT landscape.”

Still, of all its divisions only revenue from the personal systems group (PCs, tablets) was up in the quarter. Printing, enterprise services and hardware, software, and financial services all were down.

How long can that go on?

That’s why industry analyst are in what will be announced here. The news will start flowing with new storage and networking solutions.

O’Donnell said he wants to see where HP is going in cloud computing, big data and mobile, the three big trends in IT today. For all its baggage, he said, Autonomy has good capabilities for big data, as does the HP Vertica data warehouse analytics platform.

On cloud, Last month HP consolidated its cloud software and services under the Helion brand.

O’Donnell said one problem HP has is its increasingly seen by enterprises as “old guard” compared to Google, Amazon, Salesforce and other software-as-as-service and infrastructure as a service provider. HP isn’t alone, he added, — stalwarts such as IBM, Oracle, Dell and Microsoft are also in the same boat as CIOs and business users pick IT products rather than what O’Donnell calls the “illuminati’” of certified professionals in the data centre.

What HP has always lacked is a “grand vision,” O’Donnell said, that pulls together the tremendously varied products and services it has. IBM, for example, has its “smarter planet” moniker that O’Donnell says lets its leaders talk to CEOs and heads of government.