LAS VEGAS – There’s not one single person that wears the channel chief hat at Hewlett-Packard – there’s three – and HP likes it that way.

Since she took over as CEO during turbulent times for HP, Meg Whitman has undertaken a number of reorganizations of the executive chart looking to get the right team in place to lead HP’s turnaround. Staff cuts, a heavy investment in R&D and new product development are also part of the plan.

Speaking to partners on Monday at HP’s Global partner conference, Whitman said HP is slowly getting its strength back.

“We’re getting healthier, and it’s largely thanks to you,” said Whitman. “There’s a lot more work to be done, but we’re making real progress.”

HP is focused on accelerating channel growth, said Whitman – channel growth is already strongly outpacing that of HP’s direct business. Demand generation has been a focus, and last year $14.2 billion worth of leads from HP’s marketing team were channel-managed.

To focus on the channel opportunity, HP has three new executives leading the channel charge. For the enterprise group (EG), Sue Barsamian is now senior vice-president and general manager, worldwide indirect sales. She previously led EG global sales and operations. About 70 per cent of the business unit’s revenue is through the channel.

“Sue Barsamian is now 100 per cent dedicated to the channel,” said Whitman.

For HP software, Harry Gould is the channel lead as vice-president, worldwide alliances and channels, HP software field organization. He’s responsible for driving some of HP’s high-profile software acquisitions such as Vertica into the channel.

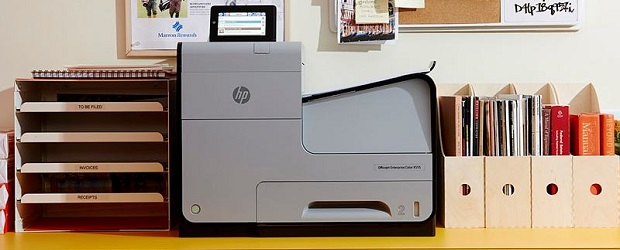

And in the printing and personal systems group (PPS), Jos Brenkel wears the channel chief hat as senior vice-president, worldwide sales strategy, PPS.

“Jos may be the best channel executive in the industry,” said Whitman.

And all three will work closely with Lynn Anderson who, as senior vice-president, demand generation and channel marketing, runs HP’s channel marketing across all business units, ensuring a common approach and one partner interface across the company.

Brenkel told CDN the three-channel chief model is working well. He works closely with Barsamian and Gould to ensure the PartnerOne program stays as unified as possible. And whenever it makes sense – such as channel marketing – roles and services are common across all three business units.

“Think of it as pipes,” said Brenkel. “As much as we can the pipes are the same, and when our competition is different we adjust the program to address that.”

A few years ago, said Brenkel, HP’s top complaint from partners was that the programs were too different. Each country, each business unit and even individual segments did their own thing. Now they’re all aligned under PartnerOne, with the same tiers and design principles. Only compensation models still vary due to different margin structures. Countries need to stick with the vanilla program, and can no longer make substantive adjustments.

“I’ve been working in channels for 24 of my 28 years at HP, and when you’ve got so many product lines to manage and markets are so different, it becomes very difficult if you don’t have one vanilla view,” said Brenkel. “This way everything that is a capability, there will only be one (across business units).”

While Brenkel also has responsibility for PPS direct sales, and has a report – Thomas Jenses – dedicated just to the channel, with 70 per cent of PPS commercial revenue coming from the channel it gets most of his focus.

“We’ve got great momentum right now,” said Brenkel. “The commercial channel business is growing at seven to right per cent, and we’re gaining share.”

One new initiative for Platinum partners Brenkel is hoping will drive further growth is partner heat maps. HP analyzes the products partners are selling by price point and form factor, and if a partner is performing below the market in a particular area they can work with the partner to identify why, and explore an opportunity for growth. Some 6,000 partners now have joint business plans with HP registered in Salesforce.com, and the heat maps are part of that.

As an example, one partner in the public sector space wasn’t getting heat in the $299 product space. Upon analysis, it was determined that was because they weren’t selling Chromebooks. They’re now taking Chromebooks into the education space and having strong success.

“It’s getting into a level of detail I don’t think any other vendors are going into with their partners,” said Brenkel. “A partner may say they don’t like a particular opportunity, but at least we’ll understand why.”