Part two of a six part series on Bitcoin.

Rarely do we get to see the creation of a new currency, let alone one that is so different from previous currencies. This creates major challenges in comprehension and comfort for most people.

Bitcoin can be compared to the advent of paper currency years ago when everyone was using gold and silver coins. Then, it must have seemed strange and confusing to attribute value to little pieces of paper instead of precious metals. Today, paper currency feels fairly safe, and trading paper for a purely digital asset like bitcoins seems odd. Furthermore, the economic and social consequences of switching to a decentralized digital currency are still unclear. Even Satoshi and the early volunteers who helped develop the concept could not have imagined precisely how Bitcoin would be used and valued by society, much as the creators of the Internet in the 1980s could not have predicted how transformative it would become.

Confusion also stems from the fact that Bitcoin is a truly complex technology. It relies not only on Satoshi’s breakthrough to achieving consensus on a distributed network but also on modern cryptographic techniques, such as digital signatures, public/private key pairs, and secure hashing.

The issuing of new currency occurs through a cryptographic lottery called mining that anyone can participate in. Mining simultaneously processes transactions made by Bitcoin users. To resist abuse from those who might want to destroy the network, Bitcoin’s design uses game theory to align the incentives of those who maintain the network and those who want to act in their own selfish interest.

Put simply, you cannot learn and completely understand Bitcoin in a single afternoon. However, we hope this book will help you understand the basics of Bitcoin as quickly as possible.

We are all Bitcoin beginners, and no one can predict with any clarity how Bitcoin will evolve, even a year or two into the future.

On the upside, this means that if Bitcoin becomes widely used in the future, the potential exists for you to become one of the early experts in

Bitcoin, since you are studying this technology at such an early stage. We hope you will be inspired by the ideas behind Bitcoin and will make your own contributions to this wonderful technology in years to come.

In our experience, the simplest way to get a person excited about Bitcoin is to have him purchase something with it. That’s how we got hooked ourselves.

Bitcoin works. After reading this chapter, you’ll understand the basics of Bitcoin—enough to chat about it at any cocktail party.

In the Bitcoin system, everyone cooperates to keep track of everyone else’s money no central authority (e.g., bank or government) is involved. To best understand how the system works, let’s walk through an example using dollars first.

Imagine only $21 million exists in the world, and there also exists a detailed list of all the people who possess that money. Everyone, including you (even though you have only $5), has a copy of this list. When you give $2 to your friend, you must subtract $2 from your entry on the list and add $2 to her entry. After informing her of the transaction, she updates her list as well. In fact, everyone in the world needs to update the list; otherwise, the list would be inaccurate. Therefore, not only do you need to notify your friend, but you also need to publicly announce that you are updating the list. If you tried to cheat the system and send your friend $1,000, your cheating attempt would be easy to catch because everyone knows you have only $5 to give.

Now, imagine that all transactions are carried out on computers that communicate via the Internet, and replace dollars with bitcoins. This is how Bitcoin works. Pretty simple actually. So why does Bitcoin seem so complex?

The answer is threefold: First is the tricky question of how the units of any new currency system (whether bitcoins or seashells) should be valued.

Should a haircut be worth 5000 bitcoins or 0.005 bitcoins? Second, many small details are involved in implementing and using Bitcoin, even though the overall concept is fairly straightforward. For example, how do you obtain a copy of the list, and how are bitcoins initially distributed? Third, an entire lexicon of new and unfamiliar words (e.g., mining) is used in the Bitcoin world.

We’ll leave the first point about the value of bitcoins for a later chapter.

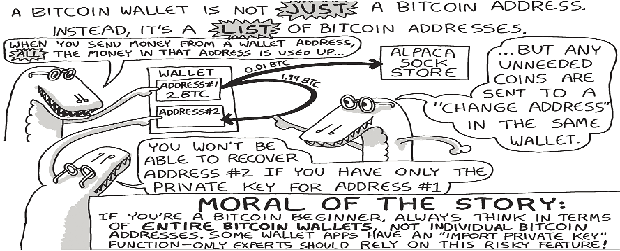

In this chapter, we’ll address the last two points by explaining the major concepts used in Bitcoin, namely the Bitcoin address, the private key, the Bitcoin wallet, and the blockchain. We’ll also briefly discuss Bitcoin mining and walk you through the process of receiving and sending your first bitcoins so you can see how the system works. But first, you need to understand the Bitcoin units in more detail.

BITCOIN UNITS

Bitcoin refers collectively to the entire currency system, whereas bitcoins are the units of the currency. Although the total currency supply is capped at 21 million bitcoins, each one can be subdivided into smaller denominations; for example, 0.1 bitcoins and 0.001 bitcoins.

The smallest unit, a hundred millionth of a bitcoin (0.00000001 bitcoins), is called a satoshi in honor of Satoshi Nakamoto. As a result, goods can be priced in Bitcoin very precisely, and people can easily pay for those goods in exact change (e.g., a merchant can price a gallon of milk at 0.00152374 bitcoins, or 152,374 satoshis).

Rather than writing the term bitcoins on price tags, merchants commonly use the abbreviated currency code BTC or XBT; 5 bitcoins would be written as 5 BTC. Despite the fact that the BTC abbreviation has been widely used since the beginning of Bitcoin’s development, more recently some merchants and websites have started using XBT because it conforms better to certain international naming standards.1 As bitcoins have appreciated in value, it has become increasingly common to work with thousandths or even millionths of bitcoins, which are called millibitcoins (mBTC) and microbitcoins (μBTC), respectively. Many people have suggested simpler names for Bitcoin’s smaller denominations, and one that has gained traction is referring to microbitcoins (quite a mouthful) as simply as bits.

- 1 bitcoin = 1 BTC or 1 XBT

- 1 BTC = 1,000 mBTC

- 1 mBTC = 1,000 μBTC

- 1 μBTC = 100 satoshis = 1 bit

Now that you know the terms for various Bitcoin units, you need to increase your Bitcoin vocabulary, so let’s talk about what is meant by a Bitcoin address.

For more on Bitcoin for the Befuddled look for the third article in this series called The Bitcoin address edition of CDN Now.

About the Author

Conrad Barski has an M.D. from the University of Miami, as well as nearly 20 years of programming experience. Barski is a cartoonist, programmer, and the author of Land of Lisp. He’s been using bitcoins since 2011.

Chris Wilmer holds a Ph.D. in chemical engineering from Northwestern University and is a professor at the University of Pittsburgh. Wilmer’s first purchase with bitcoin was a bag of honey caramels from a farm in Utah. They were delicious.