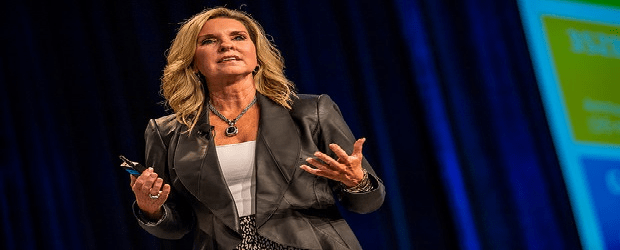

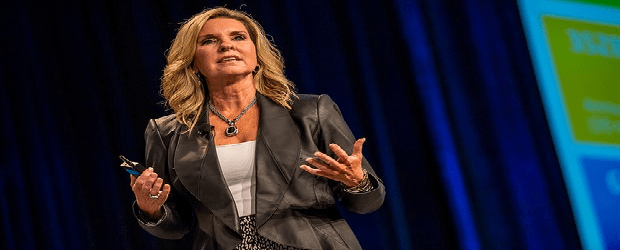

Dell has moved the needle slightly in its overall channel business said channel chief Cheryl Cook.

The Round Rock, Tex.-based vendor’s indirect business is now more than 40 per cent of global revenues based on six per cent growth overall and an 18 per cent uptick in the enterprise space. Approximately six months ago, the company said it reached the 40 per cent milestone of indirect business.

Cook said Dell also managed to obtain a better balance between large solution providers and regional VARs helped by the partnerships with distributors Ingram Micro, Tech Data and Synnex.

Meanwhile in Europe the number of new partners has exploded in the last nine months. Dell captured approximately 15,000 partners predominately in Western Europe. Compare that with North America penetration, which is fewer than 3,000 during the same time period has delighted Cook.

“There is more business in the channel in Europe than in North America and it’s not surprising either. About 50 per cent of the business there is through the channel and in some countries it’s even higher,” she said.

In terms of Dell’s channel recruitment efforts in Canada and the U.S., Cook told CDN that the company has seen positive interest from former IBM business partners, former HP channel partners and even some Cisco solution providers are taking a look at Dell now.

“Those who have become disenfranchised are now interested in Dell and we know it’s about timing and focus. Our privatization is 18 months behind us and when you look at those other companies who are re-strategizing it creates a compelling opportunity for partners to be curious and start exploring. We do have an end-to-end portfolio and the trend towards software-defined networking; we can see companies navigating to us,” Cook added.

One thing Cook has done to entice potential rival solution providers is to grandfather all certifications held by others vendors. “We want to make sure to let them know we respect their investments,” she said.

Beyond channel recruitment, Cook said her strategy is to grow share of wallet with solution providers who are aligned with Dell now.

Cook reported that deal registration is up by 25 per cent from the first quarter. Dell approved 74 per cent of those deals in North America. On a global basis deal registration is up 21 per cent with a 76 overall approval rating. In Canada specifically deal registration is up 31 per cent.

“As a consequence we are paying more rebates and about 60 per cent of our payouts are to North American VARs,” she added.

At Dell World Cook announced a $125 million investment plan for the channel. After almost six months, Cook said the Greenfield Program has more incentives and it has led to capturing 132 new accounts for Dell. The Microsoft Windows Server 2003 campaign created more than 1,600 demand generation plans that delivered more than 80,000 leads. Of those leads about 2,000 details business plans were put into action.

Cook and her team have also worked overtime on developing new methods to make it easier for channel partners to work with Dell.

“We have taken that to heart and put more focus on operational enablement. Since Dell World and the $125 million investment announcement we’ve introduced online solution configurator tools and standard bar codes for tier-2 distribution. We now have an online quoting and pricing tool so partners can do more self-service instead of engaging Dell. We want to put more dedicated resources to drive this further. The road map for that out is in the next four quarters and includes a mobile capability, deal registration, and more automated processes with the three distributors. We are a bit behind with ease of doing business because of the direct model we had in the past. But I am focused on improving the overall experience,” Cook said.